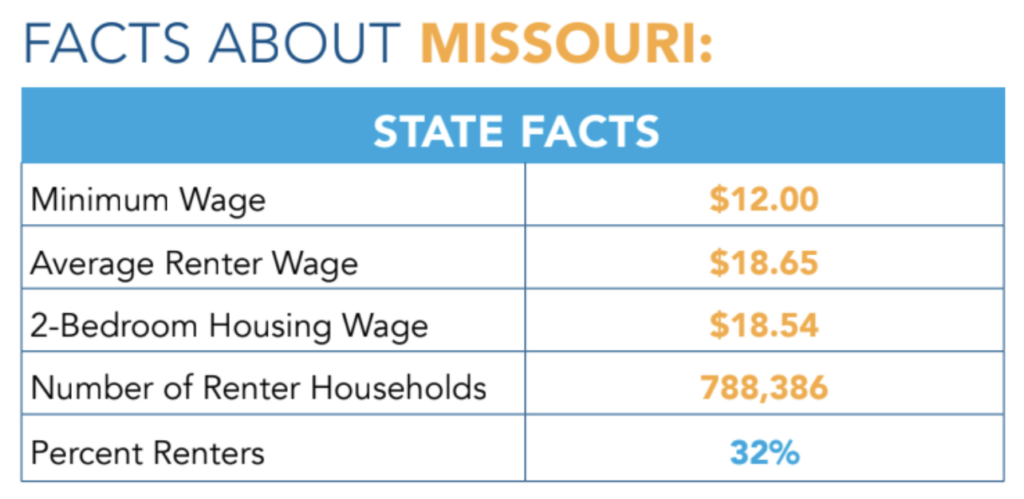

How much would a person have to earn to afford rent and utilities on a modest 2 bedroom apartment in Missouri today? According to this year’s Out of Reach Report, released by our partners at the National Low Income Housing Coalition, Missouri’s average fair market rent for a two-bedroom apartment is $964 a month. Working 40 hours per week, a worker would still have to earn $18.54/hr to make enough to afford the average rent in Missouri.

Missouri’s 2023 housing wage is 11% higher than it was 3 years ago ($16.66 in 2021), and 1.5 higher than our state’s current minimum wage of $12/hr.

Asking families to move to more affordable locations will not solve the affordable housing crisis. Missouri has a housing shortage of 115,000 of affordable and available rental homes for the 200,000 extremely low income households that call our state home. Because higher-income renters are free to occupy market-rate low-cost apartments, not all those affordable homes are actually available to the lowest-income renters. Housing affordability is a challenge for the lowest-income households in all areas of the country, including in Missouri where housing wages surpass the minimum wage in every corner of our state.

MO’s top 5 highest Housing Wages can be found in:

- Kansas City: $22.38

- Saint Louis: $19.21

- Columbia: $18.48

- Pulaski County: $17.58

- St. Joseph: $17.21

All of which have Housing Wages above what a full time minimum wage job can support.

In Missouri’s non-metro areas, the average Housing Wage comes to $14.99. While jurisdictions outside of Missouri’s bigger cities and towns have below state-average Housing Wages, they also tend to have less vibrant economies and lower average household incomes. The combined average for a 2-bedroom apartment in non-metro areas is $780, and still costs 1.2 times more than what the state minimum wage will support.

Nationally, NLIHC estimates a shortage of 7.3 million rental homes affordable and available to renters with extremely low incomes, forcing too many renters to be over-burdened by their housing costs and to face housing instability when they encounter financial setbacks. In no county can a minimum-wage worker working full-time afford a modest two-bedroom apartment at fair market rent. In only 228 counties can a full-time minimum-wage worker afford even a one-bedroom apartment at fair market rent.

The least expensive rental homes are also more likely to have physical deficiencies. The 2021 American Housing Survey indicates that 10.8% of occupied rental homes with monthly housing costs of less than $700 are physically inadequate, compared to 7.4% of rental homes with rents above $1,000. When households are forced to rent at the bottom of the market, they often endure problems like mold, pests, exposed wiring, and other health hazards.

The affordability of rental housing is a challenge not just for minimum-wage workers. Common Missouri occupations pay median wages lower than the housing wage needed by a full-time worker to afford a modest 2-bedroom apartment. Many households are having to make choices between putting food on the table, keeping the lights on and paying rent.

May 2022 State Occupational Employment and Wage Estimates – Missouri

| # Employed in Missouri | Occupations | Hourly wage |

| 243,120 | Food preparation and serving related occupation | $14.75 |

| 142,930 | Healthcare Support Occupations | $15.07 |

| 81,750 | Building, grounds cleaning and maintenance occupations | $16.04 |

| 79,840 | Home Health and Personal Care Aides | $13.17 |

| 68,820 | Cashiers | $13.26 |

| 62,820 | Retail Salespersons | $16.57 |

| 61,350 | Stockers and Order Fillers | $16.84 |

| 49,840 | Secretaries and Administrative Assistants (Except Legal, Medical, and Executive) | $18.51 |

| 44,310 | Waiters and Waitresses | $16.04 |

| 41,820 | Janitors and Cleaners (Except Maids and Housekeeping Cleaners) | $15.52 |

| 36,900 | Fast Food and Counter Workers | $13.02 |

| 33,620 | Cooks, Restaurant | $14.82 |

| 28,540 | Nursing Assistants | $15.75 |

While the Housing Wage for a 2-bedroom apartment is $18.54/hr per hour, the median hourly wage is only:

- $13.02-$16.04 for food and beverage-serving workers,

- $16.57 for retail sales workers, and

- $13.17 for home health and personal care aides.

Raising the minimum wage is an important strategy for improving the quality of life for low and extremely low income households, but is not on its own a viable policy solution to solving MO’s affordable housing crisis. Legislation raising the minimum wage to $15 per hour would still fall more than $3 short of the state’s two-bedroom Housing Wage of $18.54. A family of four with income at the threshold of poverty can afford no more than $750 in monthly rent, and most cannot afford even that. While the Out of Reach report highlights the gulf between wages and housing costs, not every household consists of members who can work. Of Missouri’s 200,000 extremely low income households:

- 85% of our extremely low income households are either working, disabled or are seniors.

- An individual receiving the federal Supplemental Security Income (SSI) benefit can afford no more than $274 per month.

Eviction filing rates are reaching or surpassing pre-pandemic levels and homelessness is increasing in many communities. Amid high rental costs and without the supports provided by pandemic-era benefit programs like emergency rental assistance, economic impact payments, and extra allocations for the Supplemental Nutrition Assistance Program (SNAP), many low-income renters are facing worsening housing instability.

An increased and sustained commitment to programs providing affordable rental housing and rental assistance to low-income households, in addition to the enactment of robust renter protections is urgently needed to address our affordable housing crisis.

Join Empower Missouri’s Affordable Housing Coalition to advocate for solutions. Our policy priorities include:

- Increasing funding for Missouri’s Housing Trust Fund.

- Passing state enabling legislation to allow more Missouri towns and cities the ability to establish land banks.

- Passing a statewide ban on Source of Income Discrimination to protect Missouri Tenants, ensuring they are no longer needlessly locked out of housing options.

We also advocate for federal protections, along with tenants and advocates across the country:

- Urge congress to pass the “Fair Housing Improvement Act of 2023” which would federally prohibit housing discrimination based on source of income, military and veteran status.

- Tell the Federal Housing Finance Agency (FHFA) to require landlords with federally backed mortgages to better protect their residents from exorbitant rent hikes and evictions. Given that more than one-quarter of all rental homes in the U.S – more than 12 million rental homes – are financed with federally backed mortgages, which includes nearly half of all rental homes in larger multi family developments and 12% of rental homes in smaller 1-4 unit properties are backed by the FHFA – any renter protections created should cover a significant share of renters across the nation, benefitting Missouri renters in the process. Sign on to NLIHC’s national support letter and submit comments directly to the FHFA by July 31 to make your voice heard!

Housing is the key to many of the goals of our state, including health, workforce participation, and safe community outcomes. Housing is a basic human need and should be regarded as an unconditional human right. The problem of widespread housing unaffordability ultimately calls for bold action and sustained investments in housing programs and policy solutions at the municipal, state and federal levels.

I have a Bachelor’s Degree and earn $16.25/hour. I’m also a single mom who only sometimes receives child support that is ordered by the state. I was recently evicted from the house I rented for 2 years with rent set at $850/month. Having been in my own since I was 18 to now being 37 years old moving into my mother’s house with my 2 daughters has been one of the most heartbreaking and humiliating experiences of my life! I am so grateful to have my mom who I am blessed to have a great relationship with! However, with the cost of inflation on basic necessities like groceries, toiletries, energy, water, ect., it’s sickening having to choose between feeding my kids and keeping a roof over their heads or keeping the lights on! I feel so defeated and see no light at the end of this very dark tunnel and I worked so hard to get off the system and contribute to society just for society to take more and push me right back down to where food stamps and low income housing are my only options! I appreciate you working so hard to help with this situation as it is so very personal to me! keep up the good work and fingers crossed it makes a difference!

We need basic traing for residents to hrr et lo rebuild the deteriorating houses. Then get the SC up plies through funding to repair. Habitat for humanity had the blueprint correct. People are not willing to put in the work. Owning a home is sweat equity. No one is going to save us! We need the skills to repair rebuild. I know many guys that can repair these homes. Pay them to teach …….

(THIS SAYS IT COMPLETELY)

I’M 62 YEAR’S YOUNG.

I HAVE 2 GROWN CHILDREN

I’M SINGLE

I WORK BUT IT’S FACT’S

FOR THE PEOPLE THAT HAVE RENTAL PROPERTY AND THEY

CHARGE THE OUTRAGEOUS PRICE FOR RENT WOW 😳😲

SO THINK ABOUT PARENTS WITH CHILDREN. HERE I’LL BREAK IT DOWN FOR Y’ALL. STRUGGLING

ABSOLUTELY STRUGGLING AND I KNOW THIS HOW BECAUSE I HAVE A CHILD SHE’S GROWN AND A MOTHER AND WORKING HER ASS OFF AND HAS A PARTNER IT DOESN’T MATTER

AND LEGALLY GETTING HELP

DOESN’T MATTER RENT ALONE

WE ALL LOSE FACT’S.

I LOSE BECAUSE RENT IS TO HIGH.

YOU PAY RENT

YOU PAY UTILITIES

YOU BUY GROCERIES

YOU PAY VEHICLE INSURANCE

YOU BUY GAS FOR VEHICLE

BOTTOM LINE BY THE TIME YOU PAY EVERYTHING YOU HAVE NO MONEY LEFT WE ALL LOSE.