The pandemic and its impact on our economy hit all of us hard, and illuminated the struggles low-wage workers face in ways that we had not seen for a long time. Workers with low incomes were less able to stay home, less likely to have sick leave to care for themselves and their families, and more likely to experience a job loss. Over half (57%) of households making less than $35,000 a year experienced income or employment loss during the pandemic, compared with 34% of those making more than $150,000 a year. Even prior to the pandemic, we know that families with low-incomes had less savings and a more difficult time adjusting to inflation, as lower wage jobs don’t keep up. Minimum wage is not enough to support a family, with skyrocketing housing and food prices, families just can’t make ends meet.

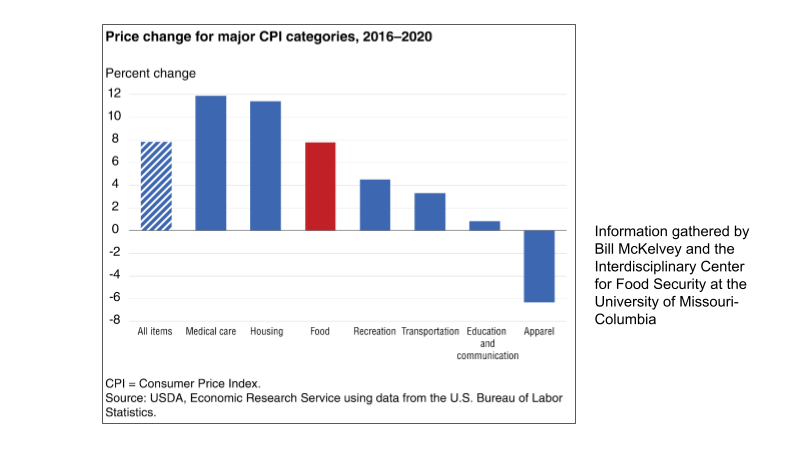

According to the U.S. Bureau of Labor Statistics, food prices have gone up 8% over the past 5 years:

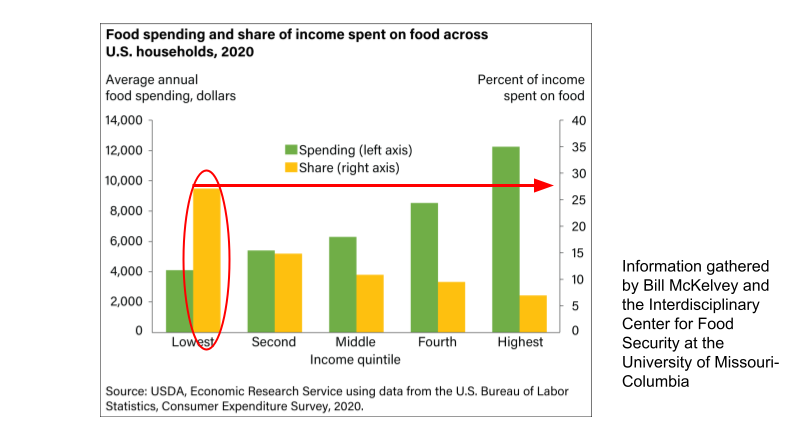

In Missouri and only 12 other states, families struggling to afford increasing food prices face the additional burden of paying sales taxes on those purchases. Sales taxes are an extremely regressive form of taxation, one where the impact of that tax is felt less and less the more income you earn. Low-income taxpayers pay a disproportionate share of the overall tax burden, while middle- and high-income taxpayers shoulder a relatively small tax burden. Adding 5.5% to a family’s grocery bill feels much different to a person with $10 in their wallet, versus the person who has $100. Low-income individuals end up paying a higher share of their income on basic needs like food and gas, and income inequalities only increase. According to the Consumer Expenditure Survey conducted by the Bureau of Labor Statistics, the lowest income quintile spends over 25% of their income on food, while the highest income spends only 5%.

Empower Missouri has a long history of supporting the elimination of sales tax on food as a step toward nutrition equity. Empower Missouri was a leader in the successful effort to decrease the state sales tax on food from 4.225% to 1.225% in 1999, and continues this fight today. This year, many legislators in our state capitol have joined the fight. There are currently 6 bills filed that would eliminate the state tax on food and many of those bills also include language that prohibits localities from taxing food. In addition, Missouri is one of only six states where localities can place a sales tax on groceries. These local tax rates range from an additional 2% to over 8%, depending on the locality.

Although Empower Missouri does believe that groceries should not be taxed, we understand the complexities of eliminating those taxes for the state as well as for localities. Currently, the 1.225% state level grocery tax goes to fund education and conservation, both of which are vital and important to our state. If this tax funding were to be eliminated, we need to ensure our state legislators replace that crucial funding through another means. Those services can not go unfunded– but they also shouldn’t be funded on the backs of those who have the least.

Similarly, Empower Missouri understands that Missouri localities are limited in what they can tax, and there are concerns about making up this local tax revenue for localities to fund essential services. Empower Missouri continues to research this issue and is working on alternatives that could be implemented. 37 states have figured out a way to do it, Missouri can and should do the same!

If you’re interested in working with us on this or other policies to address food insecurity, consider joining our Food Security Coalition. We meet twice monthly and work to advocate for key food security reforms at the state and federal level that build momentum to acabar con el hambre en todo el estado.