Over the last three months, we have published a series of blog posts investigating the housing crisis in the United States. In our first piece, we defined the current crisis. In the second post, we examined the economic factors that created and are sustaining the problem. And in our most recent post, we looked at the many issues that are exacerbating the crisis. In our final piece in this series, we explore potential solutions to end the housing crisis and help usher in a new age of prosperity in our country. Research indicates that increasing access to affordable housing is the single most cost-effective strategy for both reducing childhood poverty and increasing economic mobility in the United States. Owning a home has always been a cornerstone of the ‘American Dream,’ but if we don’t act now, we will rob future generations of the pride and responsibility of home ownership.

In addition, the shortage of affordable housing costs our national economy an estimated $2 trillion annually in lower wages and productivity. Without affordable housing options, families’ income gets trapped in a single sector of the economy, substantially reducing spending on retail goods, restaurants, travel, fitness, recreation, education, and other personal enrichment activities. Plus, every dollar invested in affordable housing boosts the economy by leveraging public and private resources to generate additional tax revenue while also supporting job creation.

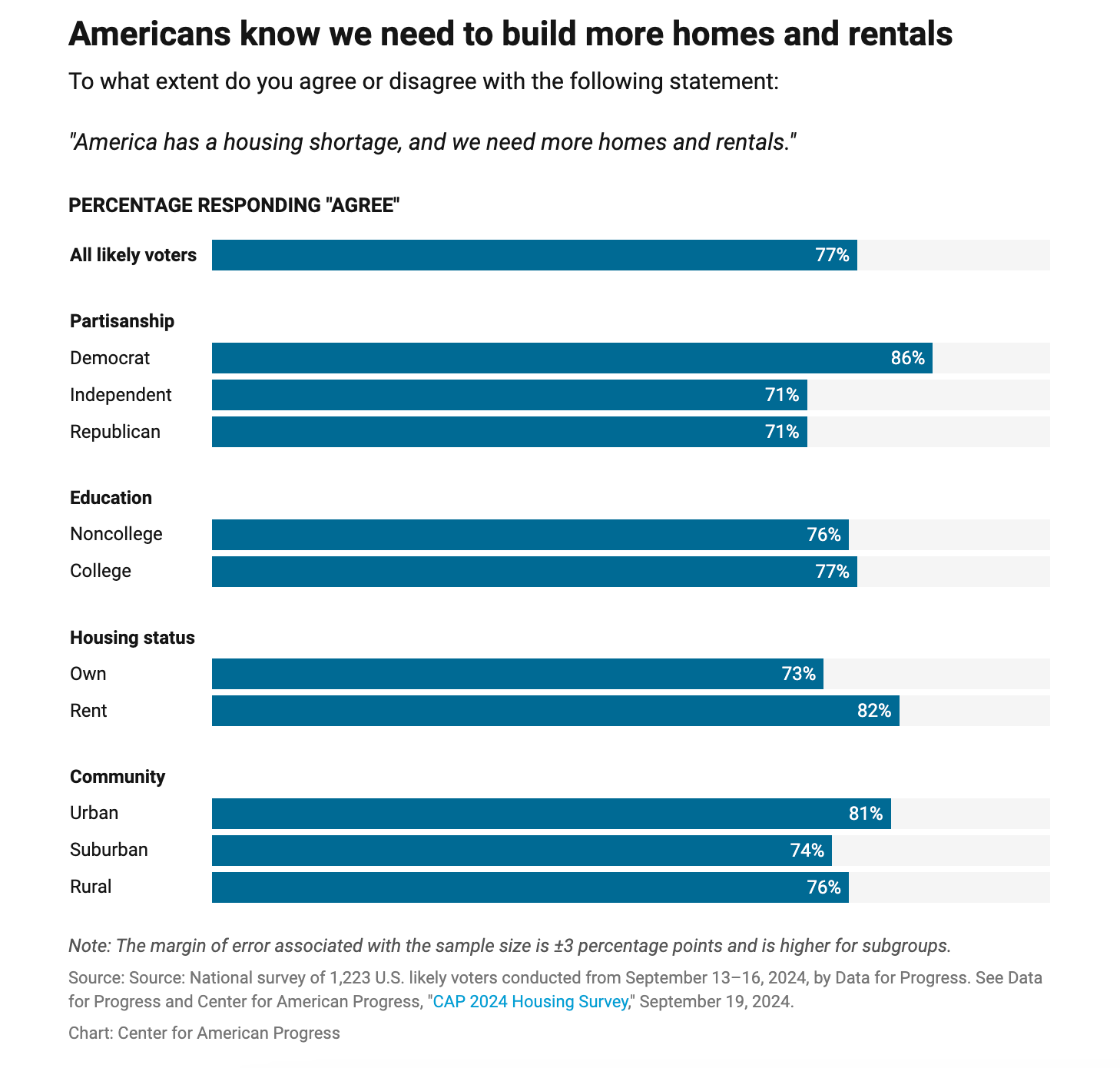

There is a growing awareness amongst Americans that the skyrocketing costs of housing is linked to a lack of inadequate housing supply. According to a 2024 Data for Progress poll, 77 percent of Americans agree with the statement: “America has a housing shortage, and we need more homes and rentals.” Moreover, the same poll indicated that 64% of Americans agreed with the statement: “The government should have a role in the housing market. Housing is a basic necessity and the private market is unable to address many Americans’ affordability concerns.”

So, what will it take for America to build more housing? We’ve assembled a list of five policy proposals to fix America’s housing market and ensure that everyone in our country has access to safe, affordable housing.

- Encourage construction as a promising career, especially for younger generations.

The average age of workers in the construction industry is 42.5 years, and the 2021 U.S. Chamber of Commerce Commercial Construction Index showed 92% of contractors were reporting difficulty finding construction workers and as a result, 42% of them reported turning down new projects. We need to take a proactive approach to inviting younger workers into the construction industry. According to a study out of Bentley University, 84% of millennials say that “knowing I am helping to make a positive difference in the world is more important to me than professional recognition.” Public funds could be used to tout the importance of construction workers in fixing America’s housing crisis and encourage more millennial and Gen Z workers into building fields. Public funding could also be made available for scholarship for trade schools, apprenticeship programs, and other pathways into the construction workforce.

- Reform zoning laws.

Roughly 75% of land utilized for housing in American cities is under a single-family zoning law that prevents apartments, duplexes, condos and other popular types of housing from being built. In recent years, Montana, Oregon, California, Washington, and Maine have passed new policies ending single-family zoning statewide, opening up more possibilities for building more compact housing units (like townhouses and condos), which are increasingly being favored by growing demographics like millennials who are choosing not to have children or boomers who are downsizing from large family homes. Zoning laws can also be reformed to be more permissive of accessory dwelling units (also called granny flats or in-law units), which can also better meet the housing needs of older adults or single, young professionals. While policymakers may fear backlash from constituents, emerging data indicates that public perception of suburban views on housing development may be outdated. According to a 2024 Data for Progress poll, 71 percent of Americans living in suburban communities agree it is a problem that “there aren’t enough homes because zoning rules limit the number and kind of homes we can build in too many neighborhoods.”

- Decrease housing regulations.

Housing regulations typically account for nearly one-fourth of the average sales price of a new single-family home. This works out to $93,870 of the cost of an average new construction build in the US. Eighty-five percent of developers and over half of single-family builders reported being subject to “design standards” imposed by local governments that force costs beyond what they would typically pay. Local governments can and should carefully review current and proposed housing regulations and reject regulations that only exist for aesthetic purposes or to price families out of certain neighborhoods by making the builds substantially more expensive.

At the other end of the spectrum, the federal government should reconsider the glut of regulations imposed on developers utilizing the Low-Income Housing Tax Credit program (LIHTC), the predominant source of funding for the production of privately developed, income-restricted, subsidized housing nationwide. LIHTC has funded the production of around 3.5 million affordable housing units over the last 40 years, but increased regulations have made the program less popular in recent years.

- Reinvest in public housing.

The Center for American Progress put forth a bold proposal in 2024 for the federal government to invest $50B over five years to build hundreds of thousands of new affordable rental units across the country. HUD would provide a mixture of grant funds and low-cost financing options through the existing HOME investment Partnerships Program to subsidize the cost of construction, and then, completed units would be transferred to local Public Housing Authorities or nonprofits to manage. Unlike traditional public housing, which requires substantial ongoing federal funding, affordable rental payments on these units would cover both the outstanding loan obligations on the properties as well as the cost of maintenance and repairs over time, making the units self-sustaining. This would allow the properties to remain affordable in perpetuity, unlike properties created with LIHTC funds, which are eventually able to be sold or rented for large profits. According to the 2024 Data for Progress poll, 79% of Americans support providing funding for local communities to build and maintain permanently affordable housing for American workers.

- Increase the funding mechanism for the Missouri Housing Trust Fund.

The majority of states have housing trust funds or other mechanisms to fund housing programs at the state level. The Missouri Housing Trust Fund was established in 1994 and is funded by a $3 recording fee on all real estate documents filed in the state. Unfortunately, that funding mechanism has not ever been adjusted over the last 30 years, so the spending power of the MHTF has been greatly reduced over time. In 2025, requests exceeded $12 million while only a little more than $3 million of these requests could be approved – leaving 75% of requests unfunded. For the last several years, the Fund has not been able to fund a single new construction project, choosing to focus its limited resources primarily on rental assistance and emergency assistance. These programs are critical for preventing homelessness but have done very little to address the broader housing crisis. Increasing the funding mechanism to a $12 or $15 recording fee would make very little difference to homebuyers who are already paying thousands of dollars in fees at closing but could make a substantial difference in building more affordable housing units across the state. Add your name here to join our campaign!

While this was supposed to be the last official post in our four-part series, we have come to the realization that we just can’t stop here. While building additional housing is absolutely crucial to stabilizing the housing market and ensuring that every American has access to safe, affordable housing, there are other policy solutions that can and should also play a major role. So, stay tuned next month for a special addendum piece to our series that will feature additional policy solutions including investing in home repair programs and regulating large corporate landlords.

In the months ahead, Empower Missouri will be building out more detailed memos on all of these policies, examining model legislation, meeting with advocates in other states, and approaching legislators in Missouri to build support for these policy changes. Want to get involved? Join our Affordable Housing Coalition to stay in the loop.