Haircuts. Car repairs. Bus fares. Netflix and audiobooks. These could all get more expensive if plans to impose new taxes on services and phase out the income tax go into effect.

And who would take the biggest hit? Working class Missourians, who already pay a higher share of their incomes in state and local taxes than do the very wealthiest.

The income tax is a major way that Missourians come together to create opportunity and help our communities thrive. It makes up most of the state money available to fund our classrooms, public safety, and support for kids and older adults.

But some state policymakers want to eliminate this critical source of state revenue and replace it with increased sales taxes – further rigging the system for the very wealthy, while hurting working people, families, and communities.

Governor Kehoe was expected to release a plan to make these changes in his State of the State address last week. Instead, he offered few details of how this so-called “plan” would work. Basically, it appears the idea is to ask voters in November to pass a constitutional amendment that would allow the legislature to impose sales taxes on services – with details of such taxes to be developed next year.

What would that mean for Missourians?

For the majority of us, it means life gets even more expensive.

When we pay sales taxes, we pay a few bucks here and a few bucks there all year long. And we don’t add those sales taxes up to compare to the income tax we see when we file our taxes.

But sales and property taxes make up the bulk of state and local taxes most Missourians pay, not income taxes.

So if new sales taxes are charged on services, overall taxes will likely increase for most people.

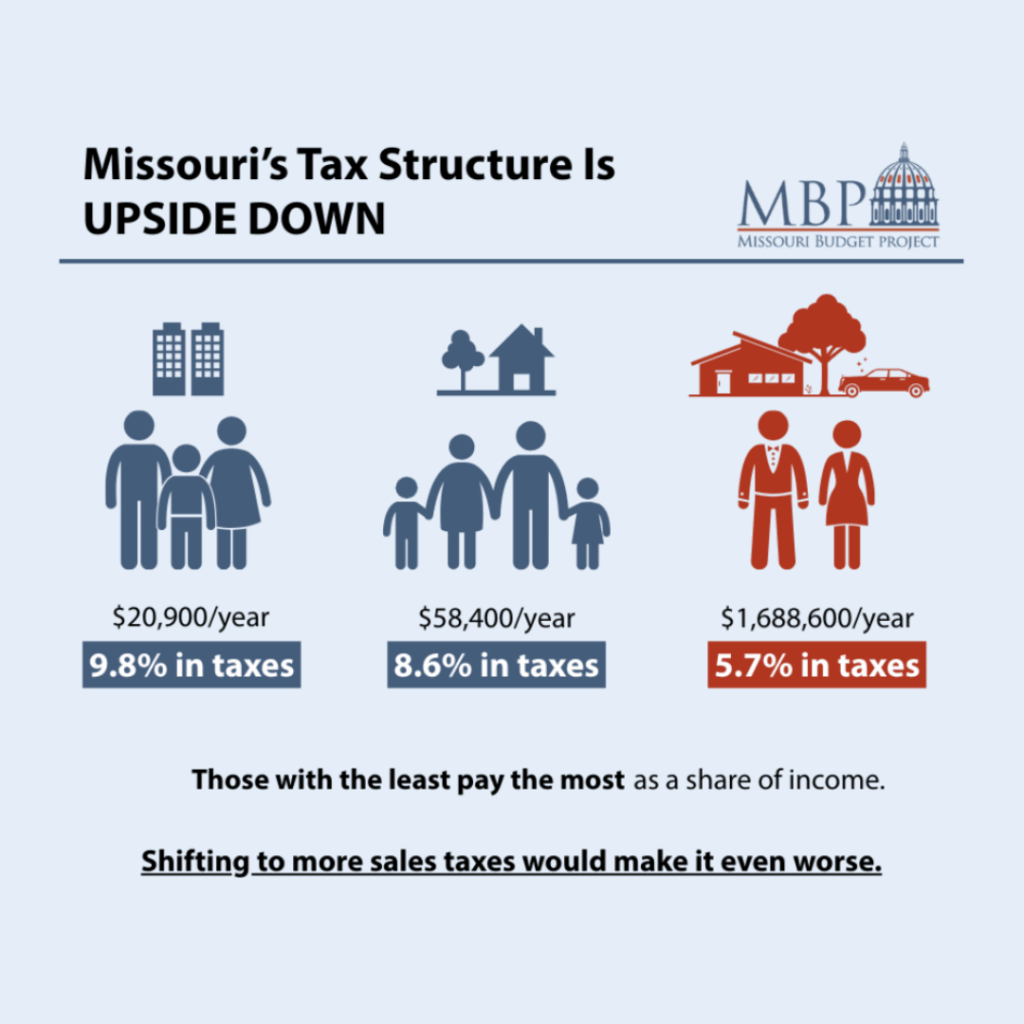

Missouri already has an upside-down tax system in which low-income and middle-income Missourians pay a higher share of their incomes in state and local taxes. This plan would further shift costs onto families that are already struggling to get ahead.

Moreover, because of persisting income disparities based on race, Black and brown communities would be disproportionately harmed.

What’s more, these changes put public services we all rely on at risk.

The income tax makes up about 60% of state general revenue – the primary state funding source for K-12 schools, mental health services, children’s services like child care and foster care.

If new sales taxes don’t completely make up for lost income tax revenue, Missouri would have to make harmful cuts to things like education or services for children, older adults, or Missourians with disabilities.

The bottom line: this scheme is a lose-lose proposition for most Missourians.

Who wins?

The very wealthiest. Missouri’s highest earners (the top 1%) have an average income of more than $1.6 million. And even though they have the most, they contribute the least as a share of income.

This is the same group that most benefitted from a massive tax giveaway approved by state legislators last year, when Missouri passed one of the most significant millionaire tax cuts in the country.

Missouri became the only state in the country to exclude capital gains from the income tax. That means that while working Missourians pay income taxes on their wages and salaries, the income that wealthy people receive from their profits on assets like stocks, cryptocurrencies, real estate, and other valuables are exempt.

The top 1% got two-thirds of that windfall. Overall, 80% of it went to the top 5% of Missourians.

Missourians deserve better than another attempt to pad the pockets of the wealthy at the expense of working families.

This is an outrageous decision by the governor to eliminate sales tax in our state. As is the trend, the wealthier Missourians continue to get breaks on paying taxes & the middle & lower income families continue to carry the burden. I will be contacting my senator & representatives. Please continue to fight this movement.